In the words of former US ambassador to El Salvador DouglasBarclay, “approximately 64% of taxes are not collected… If they were, therewould be more than enough money to improve things…”ĭata from the Central Reserve Bank shows that in 2004 tax evasion amounted toalmost USD 2.57 billion and in 2005 over USD 1.3 billion.

Suffice it to say that average monthlyexpenditure on just drinking water, electricity and telephone services amountsto USD 64.05.Īn improvement in economic conditions for the general population would requirepolicies to fight tax evasion, mainly on the part of big companies, and publicsector corruption. To cover the goods and services of the basic family basket at least fourminimum salaries would be needed. However current minimum salaries are: USD 174.24 in thecommercial and service sectors, USD 157.24 for maquila (assembly factory) workers and USD 81.46 in the agriculturalsector. The cost of the basic family basket (a family’s basic monthly needs in food,housing, education, health services, transport, etc.) was calculated at USD699.2 for April 2007.

In additionto this limited growth the trend for opportunities in the labour market has beentowards less secure types of employment, while salaries are low and the price ofpublic services has risen, all of which has reduced the quality of life andencouraged emigration ( Concertaciónpor la Paz, la Dignidad y la Justicia Social, 2007). In 20 El Salvador registered the lowest growth rates in the region(1.5% and 2.8% respectively) and in 2006 the second lowest (4.2%). Currently, out ofeach USD 100 generated, USD 62 remains in the corporate sector, USD 32 goes onworkers’ salaries and USD 6 on taxes. The Economic Commission for Latin America and the Caribbean (ECLAC, 2007)includes El Salvador in a group of six Latin American and Caribbean countriesthat it considers are able to reduce poverty and build more equitable societiesgiven a different income distribution model, which is feasible.Įl Salvador’s economic growth rate is one of the lowest in Central America andbenefits from this growth do not reach the poorest households. It is necessary to implement state policies ofwealth redistribution. Poverty reduction requires increased economic growth and reducedeconomic and social inequality. On top of all this, approval of the Special Law against Acts of Terrorism hascriminalized civil protest and social organization.ĭeteriorating economic condition of thepopulationĮxtreme poverty and social exclusion constitute a violation of human dignitythat denies the right to economic and social well-being and to develop as humanbeings. Year after year, unresolved problems with health, education, civil security,access to drinking water and other issues deepen the economic, social andcultural inequalities between a small group who hold economic and politicalpower and the great majority whose needs are not met. Theeconomic, social and political dynamic of Salvadoran society is generatingdeterioration in security and well-being to such an extent that academic sectorsclaim that the country is heading towards a “precipice”.

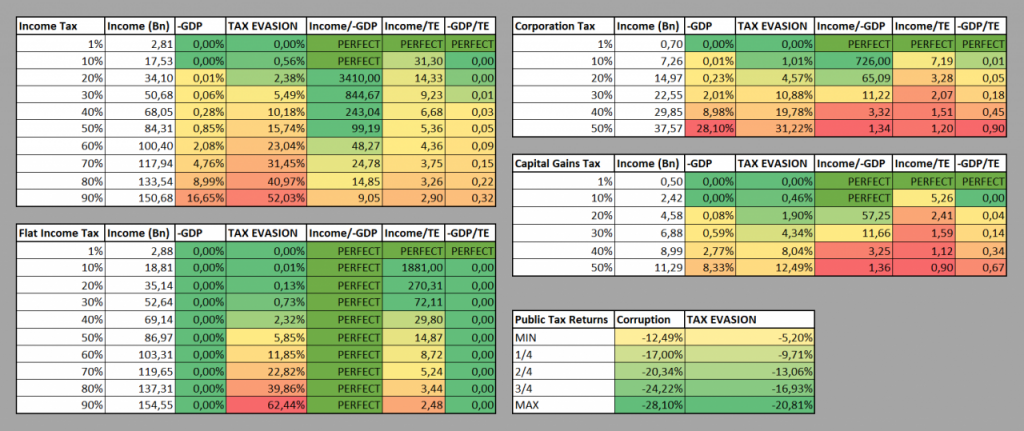

DEMOCRACY 3 TAX EVASION FREE

Civil society participation, an essential element in the promotion of inclusive social security reforms, has been threatened by the Special Law against Acts of Terrorism that adversely affects the exercise of rights to free expression and organization.

Social development indicators show some progress, but not enough, and economic growth is low with no benefits reaching the poorest households.

0 kommentar(er)

0 kommentar(er)